Australia’s self-service payroll solution

Get your payroll system running quickly.

Ready Pay by ePayroll is a comprehensive and integrated online payroll solution built for Australian businesses that require a smart, dynamic and easy set-up. Our off-the-shelf payroll software is widely used since 2002 – from your local boutique café to a medium-sized organisation with over 100 staff.

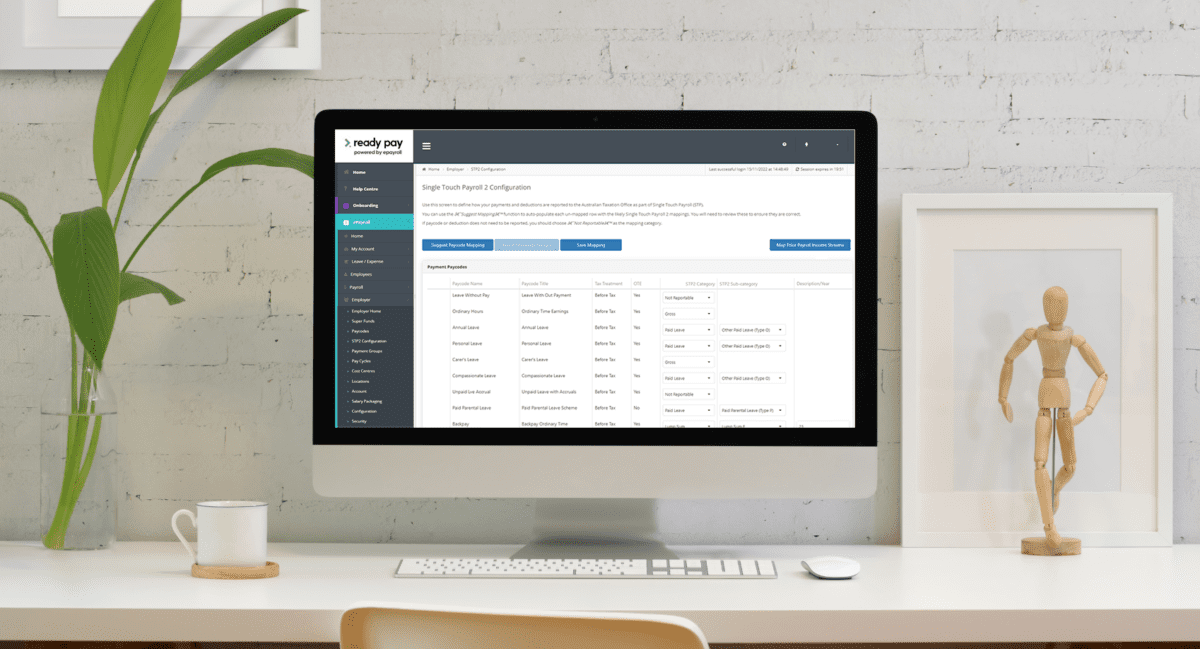

We give businesses quick access to payroll services that are compliant with Single Touch Payroll and the latest ATO regulations – allowing them to optimise their daily operations by reducing risky errors whilst boosting compliance and accuracy.

Our off-the-shelf online payroll system is designed for time-poor business owners. Our system is mobile-friendly, secure, ready to implement and simple to use. Start a free trial to gain quick access to Employee Self-Service, time and attendance, on-demand reporting, leave management, employee onboarding, mobile app and much more!

Our pay-as-you-go payroll for employees means no lock-in contract. Monthly charges are applied by active employees so whether you have casual workers or growing rapidly, your payment plan is cost-efficient and adjusted to the needs of your business.

For many business owners, payroll and compliance can be a foreign, daunting or difficult function to manage. With Ready Pay, you don’t need to worry, we build our payroll system to be compliant to Australia’s latest regulations, including payment of salaries and wages, allowances, deductions and other payments, PAYG withholding and superannuation and STP reporting.

Ready Pay by ePayroll is the smarter, easier way to do payroll for your business. Fully automated and online, it streamlines the payroll function and ensures total compliance with payroll-related legal obligations.

Run payroll in just 4 steps:

Our software is designed in Australia for Australian businesses, meaning your payroll complies with local legislation.

Scale your service offering of an automated, intuitive and streamlined payroll management system by joining our Ready Pay by ePayroll Partner Program. You can white-label our sophisticated and easy-to-use online payroll system with your company branding, for a low-cost and always compliant option. We have two partner programs that can suit your requirements, including support and training.

INCLUDES:

We are an innovator and leader in the payroll service industry, being the first to develop online payroll processing software in Australia. We continue to evolve and update our cloud software, ensuring we stay innovative and cost-efficient. We have Employee Self Service and Leave Management features built into our online payroll system.

Employee Self-Service (ESS) is a secure, online portal where employees can access their information anytime, anywhere.

Run a range of reports 24/7 for secure and insightful payroll and HR data, in PDF, CSV or XLS formats.

Allow employees to project and apply for leave efficiently, giving your business full visibility and approval – including customising public holidays relevant to your business or state.

A central, secure resource library for important employee materials with restrictions that can be controlled by who can add, view or delete documents.

Our system can help you design salary packaging structures that are tax efficient yet fully compliant, customised to your unique employee remuneration.

The in-built superannuation feature ensures on-time and accurate contributions to any super fund via SuperStream. Have total visibility and tracking of every payment, auto-processed and up-to-date.

Automate the general ledger uploads at the end of each payroll process, configure payroll codes with specific GL codes and integrate with existing account systems like MYOB, Xero, JCurve, Accpac, Netsuite, Accounts IQ and more!

Automate onboarding from day one. Our platform creates employee profiles and prompts new employees to fill in important details for payroll and superannuation, complete contracts and view onboarding videos or documents.